Accountant vs. Bookkeeper Salary in the UK blog

Accountant vs. Bookkeeper Salary in the UK blog

Introduction

Money management is the heart of every business and organisation, and finance professionals ensure it stays healthy. If you are looking for a career in financial management in the UK and looking to find out the differences in their roles and responsibilities and how much bookkeepers make vs. accountants’ salaries in the UK.

Roles & Responsibilities of a Bookkeeper

Bookkeepers mainly focus on day-to-day recording tasks involving financial transactions, managing invoices, and reconciling bank statements. Their primary goal is to ensure that the organisation’s financial records are accurate, up-to-date, and compliant with relevant regulations.

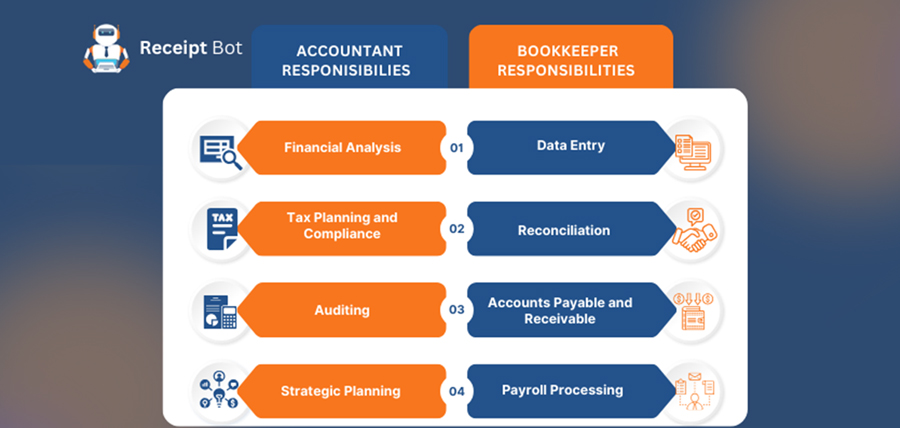

The primary responsibilities of a bookkeeper include the following;

- Data Entry: Bookkeepers record financial transactions, including sales, purchases, expenses, and receipts, in accounting software or ledgers.

- Reconciliation: They reconcile bank statements, ensuring that the recorded transactions match the actual bank transactions.

- Accounts Payable and Receivable: Bookkeepers manage invoices, track payments, and follow up on outstanding invoices (accounts receivable) or pay bills (accounts payable).

- Record Keeping: They maintain accurate records of financial transactions, making sure all documentation is organized and accessible.

- Financial Reports: Bookkeepers generate basic financial reports like profit and loss statements and trial balances.

- Payroll Processing: Some bookkeepers handle payroll tasks, including calculating wages or taxes or issuing paychecks.

Roles & Responsibilities of an Accountant

On the other hand, accountants are the financial architects of any organisation, both large and small. They play a crucial and pivotal role in ensuring the financial health and stability of the business are up to the mark.

Accountants handle diverse responsibilities, from tracking day-to-day financial transactions to conducting thorough audits, analysing budgets, and offering strategic financial counsel.

Here is a list of everyday tasks performed by accountants:

- Financial Analysis: Accountants analyze financial data to provide insights and recommendations for decision-making. They create financial statements like balance sheets, income statements, and cash flow statements.

- Tax Planning and Compliance: Accountants help individuals and businesses comply with tax regulations, minimize tax liabilities, and accurately prepare and file tax returns.

- Auditing: Some accountants specialize in auditing. They review financial records and statements to ensure accuracy and compliance with accounting standards and regulations.

- Financial Reporting: Accountants prepare and present financial reports to stakeholders, including shareholders, management, and government agencies.

- Strategic Planning: They often participate in strategic planning, helping organizations set financial goals and develop budgets.

Skills Required to Tap into the Job Market

Entering the job market, especially in finance, demands specific skills and competencies to stand out. Whether you’re considering a career as an accountant or a bookkeeper in the UK, here are the essential skills that will open doors and help you thrive in this dynamic field:

- Numerical Proficiency

- Attention to Details

- Data Analysis

- Being Tech Savvy

- Financial Software Proficiency

- Analytical Thinking

- Continuous Learning

Being tech-savvy is a crucial skill nowadays. It means you know about the tools and technologies that can help improve the bookkeeping and accounting process. Receipt Bot is a bookkeeping bot that can automate manual entry and save you time for more critical tasks.

How to Get Started in the Job Market

To launch your career in finance as an accountant or bookkeeper in the UK, start by acquiring the necessary education and skills. Build a strong resume that showcases your qualifications and gain practical experience through internships or entry-level positions.

Network with professionals, consider specialisation and prepare for interviews. Stay informed about industry trends, apply strategically, and be persistent in your job search.

Seeking mentorship and embracing lifelong learning are critical to a successful career. For job opportunities in the finance sector, you can visit job platform like Jooble to explore openings and kickstart your journey in the job market.

Salaries in the UK Finance Sector

Both fields can offer lucrative career paths once you get enough experience and skillset.

How much do Bookkeepers make in the UK?

Bookkeepers in the United Kingdom typically earn competitive salaries influenced by experience, location, and specialisation. According to Indeed, a median bookkeeper salary in the UK averages £25,998 per year or £15.82 per hour.

For those starting their career, the initial income is often on par with entry-level accountants. However, it is worth noting that specialisation in a specific niche can lead to higher earnings.

The salaries also differ from industry to industry; suppose a bank bookkeeper’s salary might differ from an automotive bookkeeper’s salary or an online/freelancer bookkeeper’s salary.

Additional certifications, like ACCA, can open doors to even more lucrative opportunities because an ACCA salary in the UK is higher than that of a bookkeeper. The salary landscape can evolve, so staying informed about industry trends is crucial.

How much does an Accountant make in the UK?

When considering a career in accounting in the United Kingdom, it’s crucial to understand the financial aspects of this profession. Accountants play a pivotal role in financial management, and their salaries reflect the significance of their expertise.

Indeed reports that the entry-level accounting salary in England averages £26,814 per year. This figure of an accountant’s salary in the UK showcases the competitive compensation even at the start of an accounting career.

The earning potential is even more promising for those aiming to become chartered accountants. According to Reed, the average chartered accountant’s salary in the UK is £46,080 annually, meaning that a chartered accountant’s salary in the UK per month can be as high as £3,840.

It is important to note that salary levels may vary based on experience, location, and industry.

Conclusion

In conclusion, the world of financial management in the United Kingdom offers diverse opportunities for those interested in careers as accountants and bookkeepers. These roles are financially rewarding and vital for the success and stability of businesses and organisations.

Aspiring professionals in these fields should strive to develop the necessary skills, seek continuous learning, and approach their career journeys strategically.

Both accountants and bookkeepers contribute significantly to the financial well-being of their clients and employers, making them integral players in the UK job market.