Bank Statement PDF to CSV Conversion – Ordinary OCR vs Receipt Bot OCR

Whether you are an accountant, a bookkeeper, or someone trying to keep their finances in check, dealing with bank statements is necessary, and the most hated part is the manual data entry work involved in converting bank statement PDF to CSV.

Exporting PDF bank statements into Excel to extract transactions can be a complex task for several reasons. Firstly, bank statements often come encrypted, adding a layer of difficulty to data extraction. Moreover, the layout of transaction grids varies significantly across different banks, introducing inconsistencies in data format. A common issue is the occurrence of dates being printed only once per day, leaving several transactions without explicit date stamps. Additionally, bank statements often include unnecessary information for accounting purposes, such as opening and closing balances, which complicates the import of transactions into accounting software.

Moreover, the task of importing bank statements data into accounting software is further complicated by format incompatibility issues, such as the need for specific file types like QBO (Web Connect), QFX, or OFX.

These hurdles frequently lead to inability of directly copying data, necessitating time-consuming manual data entry and heightening the risk of errors. In such cases, if you hire a professional data entry staff, the hourly wages can be a huge cost.

What Sets Receipt Bot Bank Statement Converter Apart?

Receipt Bot leverages OCR (Optical Character Recognition) and ML (Machine Learning) technology to tackle these challenges head-on. Our bank statement converter streamlines the process, eliminating the need for manual data entry or data cleaning, thereby saving valuable time and reducing errors.

More Accurate Data Extraction

Leveraging the power of OCR/ICR and natural language processing (NLP) techniques, Receipt Bot conducts more than forty arithmetical and logical accuracy checks. These validations ensure highly accurate data extraction from PDF bank statements, minimizing errors.

Intelligent Sorting & Validation

Receipt Bot can recognize PDF statements with smart context-specific training and assign relevant document types like bank, credit card, load or PayPal statements. It standardizes the data, ensuring every transaction is correctly categorized as money received or spent.

Moreover, it can organise data from different periods or accounts and flag duplicate and missing pages.

No Need for Templates

Unlike other OCR solutions that require complex template setups, Receipt Bot keeps things simple. You can download consistent Excel formats without the hassle of template design.

Cloud-Based Convenience

Receipt Bot operates on a cloud-based platform, offering adaptability and ease of access to modern accounting firms. With just an internet connection, users from any location can utilize the service, making it a perfect choice for on-the-go accountants and entrepreneurs.

Download data in any format

You can export bank statements to Excel and various other formats, including PDF to OFX, QBO, QIF, QFX, and a range of CSV formats. These are designed for seamless integration with multiple accounting software platforms like Xero, QuickBooks, or Sage.

If the exact CSV format isn’t immediately available, you can design your own custom CSV format. Should you require more technical formats, we can also develop that for you, with a turnaround time of just one week.

Easy as 1-2-3

Using Receipt Bot is so easy. In just three simple steps, you can transform your PDF bank statements into CSV:

- Step 1: Upload bank statements via mobile app, email, web, or API. Refer to the following article for details: how to upload bank statements.

- Step 2: : Analyse bank statement extracted data to ensure accuracy.

- Step 3: Export bank statements to Excel, CSV, OFX, Web Connect (or in any format you want).

Cases where Receipt Bot is better than ordinary OCR

The difference can be easily felt once you start using the OCR services of Receipt Bot. But here are some examples to give you a sneak peek into advanced extraction results by Receipt Bot and the results of ordinary OCR software with the same input.

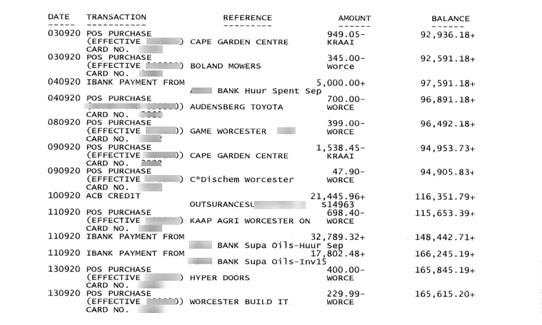

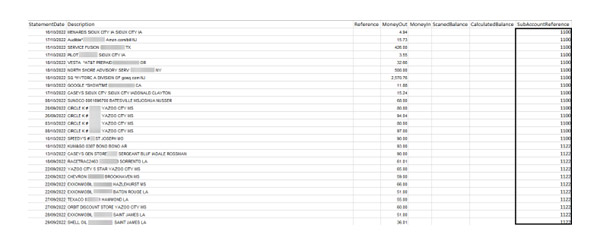

1. Data Organization

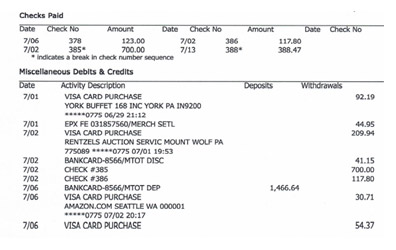

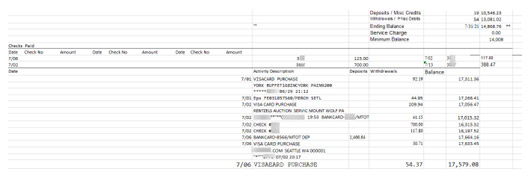

Sometimes, bank statements come in a tricky format. They don’t neatly separate numbers into different columns. Instead, everything gets jumbled up. When this happens, regular OCR software gets confused and mixes up and merges the values of different columns, making a real mess. Fixing this mess could sometimes require hours of manual work to sort things out.

This is where Receipt Bot shines. It’s like having an intelligent helper who can unscramble the mess and put everything in the right place. So, even with messy bank statements, Receipt Bot can make sense of it all and put the values in the columns to which they belong.

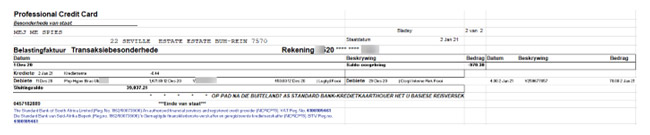

Original Statement

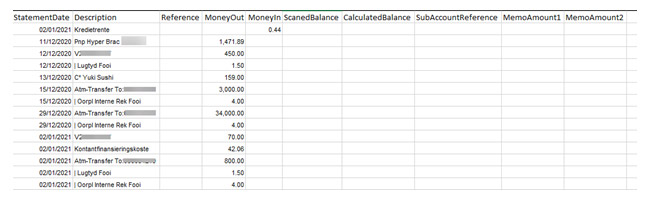

Ordinary OCR Output

Receipt Bot’s Output

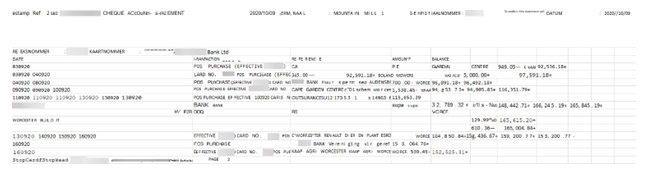

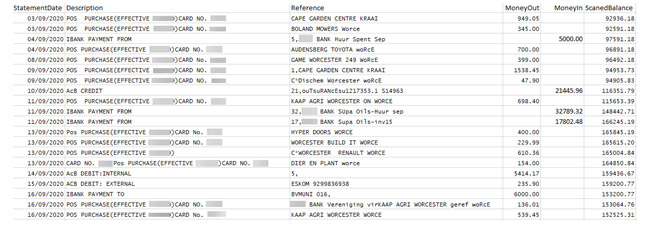

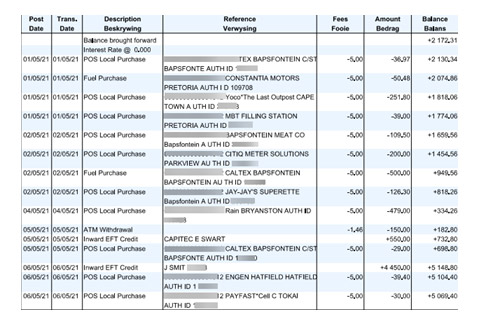

2. Excluding the unnecessary data

Statements have unnecessary data like policies or terms & conditions, which you mostly don’t need in your spreadsheet.

A simple OCR software can not distinguish between accounting data and non-accounting data. Therefore you end up cleaning up the unnecessary data from your spreadsheet after extraction.

Receipt Bot is equipped with machine-learning algorithms that identify and extract the transaction data.

Original Statement

Ordinary OCR Output

Receipt Bot’s Output

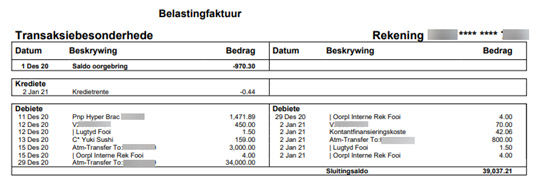

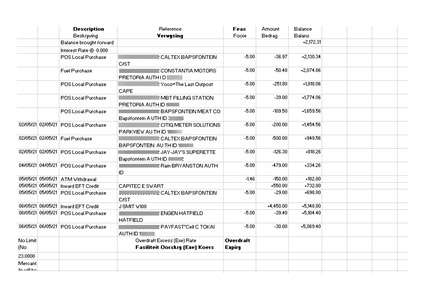

3. Sub Account Extraction

Credit card statements can be futher technical to extract as they contain data for different cards or accounts in a single document.

Regular OCR software do not have any context about sub-accounts in a document and they provide in a single grid for different sub-accounts.

Receipt Bot’s smart algorithm can spots sub-accounts within a statement and sorts out the transactions for each account, keeping them nicely organized for your analysis.

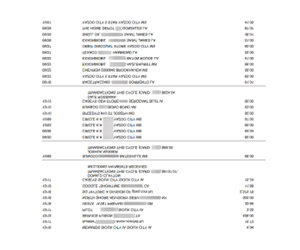

Original Statement

Ordinary OCR Output

Receipt Bot’s Output

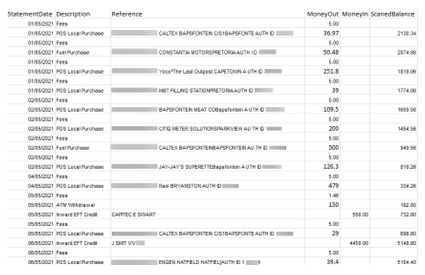

4. Separate transactions for Fee Column

Certain financial institutes include fee details in a separate column for each transaction. These details are essential for reconciling bank statements because they affect the statement balance.

Ordinary OCR extracts the fee data in a column, which requires you to create a separate row for each fee column to perform the bank reconciliation.

On the other hand, Receipt Bot takes a more thoughtful approach. It analyses bank statements and identifies whether a column value impacts the statement balance. It outputs a separate transaction to capture the impact of the service fee, making the data extracted ready for bank reconciliation purposes.

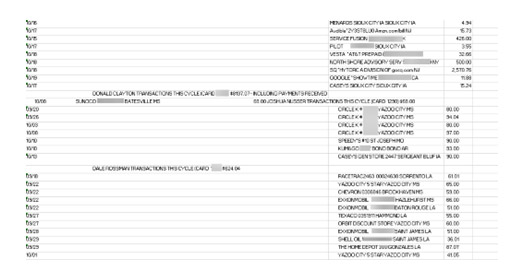

Original Statement

Ordinary OCR Output

Receipt Bot’s Output

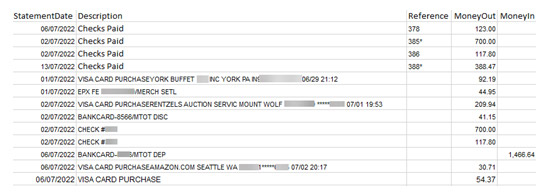

5. Extraction of Check’s Transaction

Mostly, the transaction for checks are printed separate from other transaction in the bank statement PDF.

Running ordinary OCR software on these statements results in check transactions being missed or appearing in different format, and you need to manually stitch the data together to get an accurate view of balance.

On the contrary, Receipt Bot extract the data for check transactions and stitches together with other transaction to maintain accurate running balance.

You also have the option to process check copies in the statement get processed separately as payment receipts for invoices.

Original Statement

Ordinary OCR Output

Receipt Bot’s Output

6. Extraction of PayPal Statements

PayPal Statements are one-of-a-kind statements with issues like money in and out being in the same column, different columns for fee transactions, and transactions with different currencies.

These problems require complex technicality during the extraction, which a regular OCR software cannot handle.

However, Recepit Bot has advanced functionality to extract PayPal statements in a way understandable for a non-specialist for analysis and also importable to different accounting software.

Original Statement

Ordinary OCR Output

Receipt Bot’s Output

Summary

Scanning PDF bank statements into Excel is a simple task using ordinary OCR tools. Still, due to the factors mentioned above, you end up spending more time on cleansing extracted data or just trying to format it according to your needs.

Receipt Bot simplifies the process with its OCR-based bank statement converter.